>> Top 10 des incontournables à faire et visiter à Lisbonne

1. Prenez de la hauteur, la capitale portugaise est construite sur des collines et les points de vue (miradouros) sont splendides.

2. Perdez vous dans les vieux quartiers (Alfama, Mouraria), si vous aimez les couleurs et les motifs vous serez émerveillé par les faïences et le street art. Omniprésent.

3. Tombez amoureux/amoureuses des habitantEs, des arbres, des chats, des tramways, des pâtisseries. C’est une ville où l’on tombe amoureux. Inévitablement.

Quartiers de Lisbonne

A ne pas rater : Alfama, Bairro Alto, Belem et Ajuda, Pour les curieux : Baixa, Estrela et Campo de Ourique Hors des sentiers battus : Rive sud

Lieux à visiter et activités à faire

Monuments : Monastère des Hiéronymites, Chateau de Lisbonne, statue du Christ, belles places, Couvent des Carmes Musées : Musée d’art ancien, Musée Gulbenkian, MAAT, Musée des azulejos Parcs : Serres froides, Aquarium de Lisbonne, Beaux jardins, plages, points de vue sur Lisbonne Activités : Visites guidées, marchés, boutiques traditionnelles, croisières de voiliers sur le Tage, visiter Sintra

Manger, boire et danser

Avec un verre : Bars insolites, cafés atypiques Avec appétit : Déjeuner au bord de l’eau Pour sortir : Concerts à Lisbonne

Pratique à Lisbonne

Hébergement : Auberge de jeunesse, hôtels pas chers, hôtels de charme Pratique aussi : Rejoindre le centre de Lisbonne depuis l’aéroport, transport en commun

Quelques photos avant votre visite du Portugal

Choses à faire à Lisbonne : Endroits incontournables, lieux essentiels et coins insolites

1. Miradouro, point de vue sur Lisbonne

Appelée aussi la ville aux 7 collines, Lisbonne bénéficie de belvédères naturels offrant de jolis points de vue sur la capitale portugaise. Découvrez les meilleurs endroits pour profiter d’un superbe panorama. C’est magique et cela laisse rêveur…

2. Monastère des hiéronymites à Lisbonne

Inscrit au patrimoine mondial de l’Unesco, le Monastère des Hiéronymites est un ensemble remarquable de style manuélin, caractérisé par des motifs d’inspiration marine. De nombreux bâtiments notamment une incroyable église et un très beau cloître, des jardins, une nécropole royale et les tombeaux de Vasco de Gama et de Pessoa.

3. Serres froides de Lisbonne : Merveilleuse Estufa fria

Estufa Fria : Voici le jardin le plus impressionnant de la capitale portugaise. Retour à la case jurassique, tellement le lieu rappelle une végétation quasi-préhistorique. Je suis conscient que cela ne veut pas dire grand chose lu comme ça sur internet, mais allez-y et on en reparle.

4. Couvent des Carmes à Lisbonne : Un miracle trop loin

Le couvent des Carmes a été en grande partie détruit par le tremblement de terre de 1755. Le plafond s’est écroulé le jour de la Toussaint. Il n’en fallait pas plus aux philosophes des lumières pour enterrer Dieu. L’édifice abrite aujourd’hui le petit musée archéologique du Carmo. Une visite insolite entre crépusculaire et romantique.

5. Aquarium de Lisbonne : Magique !

L’Océanarium de Lisbonne (pour être exact) accueille plus de 15 000 espèces parmi lesquelles le requin, le mérou, le poisson-lune et le manchot, mais aussi les oiseaux de mer, les coraux, les amphibiens et les mammifères marins. Une visite qui ravira les adultes comme les enfants.

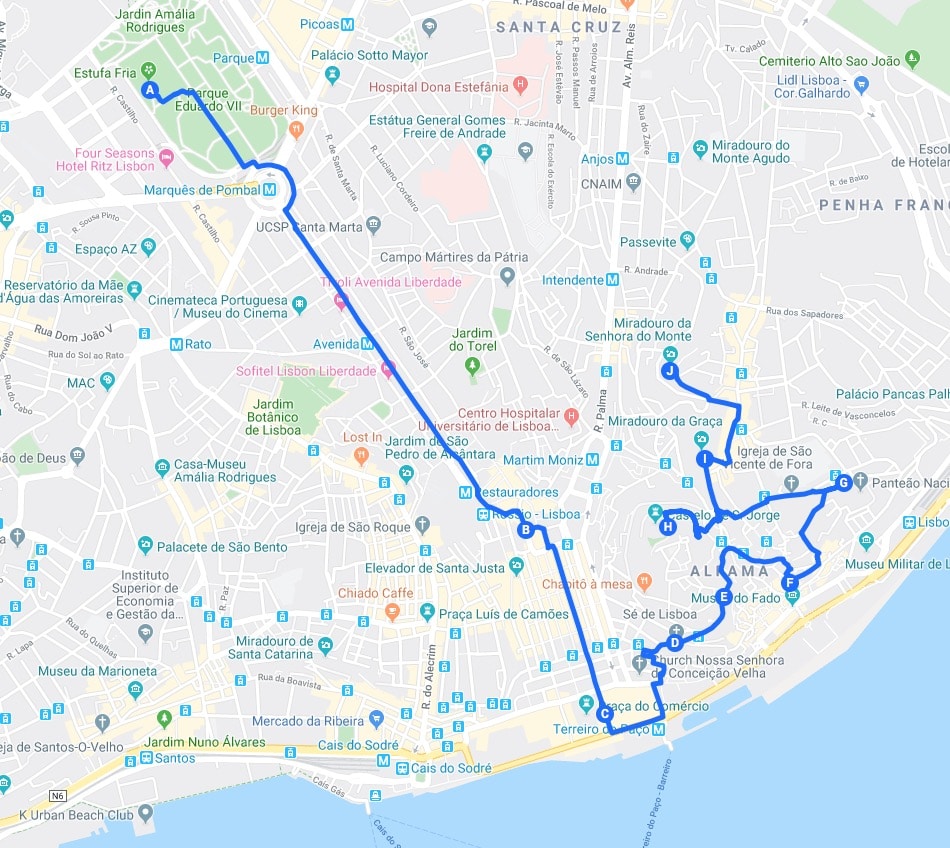

Itinéraires pour visiter Lisbonne en 1, 2 ou 3 jours

Voici une suggestion de lieux à visiter à Lisbonne à travers des itinéraires en 1, 2 ou 3 jours sur carte. Retrouvez tous les lieux dans notre guide touristique.

Visiter Lisbonne en 1 jour

A venir !

Visiter Lisbonne en 2 jours

Jour 1 à Lisbonne : Itinéraire dans les quartiers de Baixa et d’Alfama.

On commence par le plus beau jardin botanique de la ville pour ensuite descendre les champs-Elysés lisboètes et rejoindre l’hypercentre plat de Baixa. Nous remonterons ensuite vers la cathédrale, le chateau et le quartier d’Alfama.

Au programme : Jardin, belles places, impressionnantes églises, vues spectaculaires, du street art et des bars insolites et sympas.

Jour 2 à Lisbonne : Itinéraire dans les quartiers de Bairro Alto, Estrela et Belem

On commence par le « quartier latin » pour traverser le Bairro Alto entre jolis parcs, églises et points de vue. On rejoint ensuite une autre colline plus à l’ouest dans le quartier chic et vert d’Estrela. On redescend vers plusieurs musées intéressants avant de gagner le quartier de Belem et sa marina.

>> Consultez l’itinéraire précis et détaillé pour visiter Lisbonne en 2 jours en cliquant sur l’image ‘Itinéraires à Lisbonne’ en dessous.

Visiter Lisbonne en 3 jours

Consultez l’itinéraire précis et détaillé pour visiter Lisbonne en 3 jours en cliquant sur l’image ‘Itinéraires à Lisbonne’ en dessous.

Visiter Lisbonne en 2 jours : Jour 1, itinéraires dans les quartiers de Baixa et Alfama

On commence par le plus beau jardin botanique de la capitale portugaise pour ensuite descendre les champs-Elysés lisboètes et rejoindre l’hypercentre plat de Baixa. Nous remonterons ensuite vers la cathédrale, le chateau et le quartier d’Alfama. Au programme : Jardin, belles places, impressionnantes églises, vues spectaculaires, du street art et des bars insolites et sympas.

Estufa Fria.

L’un des plus beaux jardins botaniques et surement le plus impressionnant avec ses grandes serres et sa végétation luxuriante.

Place de Rossio.

Voici la plus charmante place de Lisbonne. C’est aussi la plus ancienne place de ville et le lieux d’évènements heureux et sanglants. Dans la 2e catégorie : Exécutions, corridas et autodafés.

Place du commerce.

L’ancienne place royale dégage un sentiment d’harmonie et de majesté. La statue équestre représente le Roi Joseph Ier au pouvoir lors de la destruction de Lisbonne en 1755 suite au tremblement de terre.

Cathédrale Sé de Lisbonne.

Construite à la fin du 12ème siècle à l’emplacement d’une mosquée, La cathédrale Santa Maria Maior de Lisbonne ou Sé Patriarcal de Lisboa est aujourd’hui la plus ancienne église de ma ville.

Miradouro Porta del Sol.

L’une des vues les plus belles et les plus touristiques du quartier de l’Alfama à Lisbonne.

Miradouro Santo Estevao.

Une vue moins connue et très agréable pour apprécier le spectacle des toits du plus ancien quartier de Lisboa.

Marché aux puces de Lisbonne.

Le « marché aux voleurs » est le rendez-vous des collectionneurs, amateurs de fripes et aussi…des voleurs. On y trouve de tout dans une ambiance bon enfant.

Chateau de Lisbonne.

Appelé également château des Maures, le château Saint-Georges impressionne par ses hautes tours et ses murs crénelés. Un lieu très touristique avec une belle vue. Pour les passionnéEs de chateaux médiévaux.

Miradouro de Graça.

Peut être la plus belle vue de Lisbonne sur le Chateau, la ville, le Pont du 25 avril au loin. Vous pourrez apprécier la vue à l’ombre de jolis pins et boire un verre en terrasse. Les prix restent extraordinairement accessibles pour le lieu.

Miradouro da Senhora do Monte.

Un autre point de vue magique. Point d’arrivée des colonnes de tuk-tuk. Pas toujours aussi romantique qu’on pourrait l’espérer mais assez spectaculaire malgré tout. Redescendez en direction d’Intendente pour boire un verre dans un des nombreux bars alternatifs du quartier : Crew Hassan, Casa Independente, RDA 69…

Longueur du trajet : 8 km.

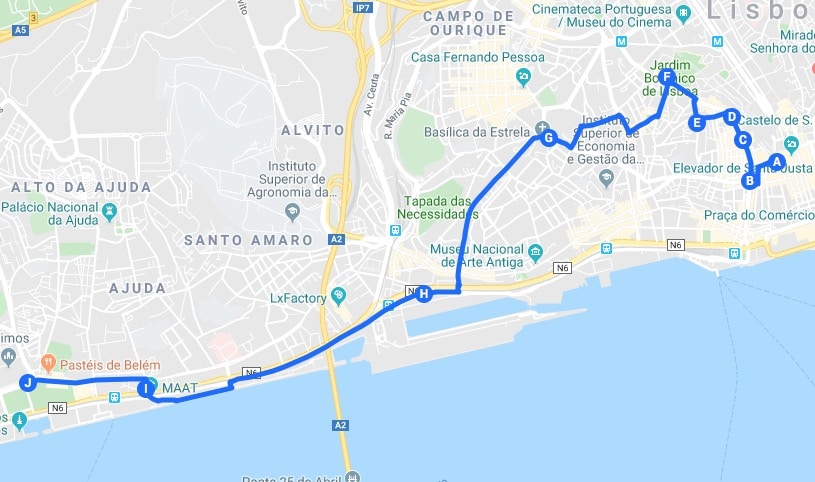

Visiter Lisbonne en 2 jours : Jour 2, à travers les quartiers de Bairro Alto, Estrela et Belem

On commence par le quartier latin pour traverser le Bairro Alto entre jolis parcs, églises et points de vue. On rejoint ensuite une autre colline plus à l’ouest dans le quartier chic et vert d’Estrela. On redescend vers plusieurs musées intéressants avant de gagner le quartier de Belem et sa marina.

Eglise des Carmes.

Le couvent des Carmes a été en grande partie détruit par le tremblement de terre de 1755.

Place Camões.

Une place charmante du quartier de Chiado : Le quartier latin de Lisbonne avec théâtres, librairies et de nombreux et agréable cafés historiques.

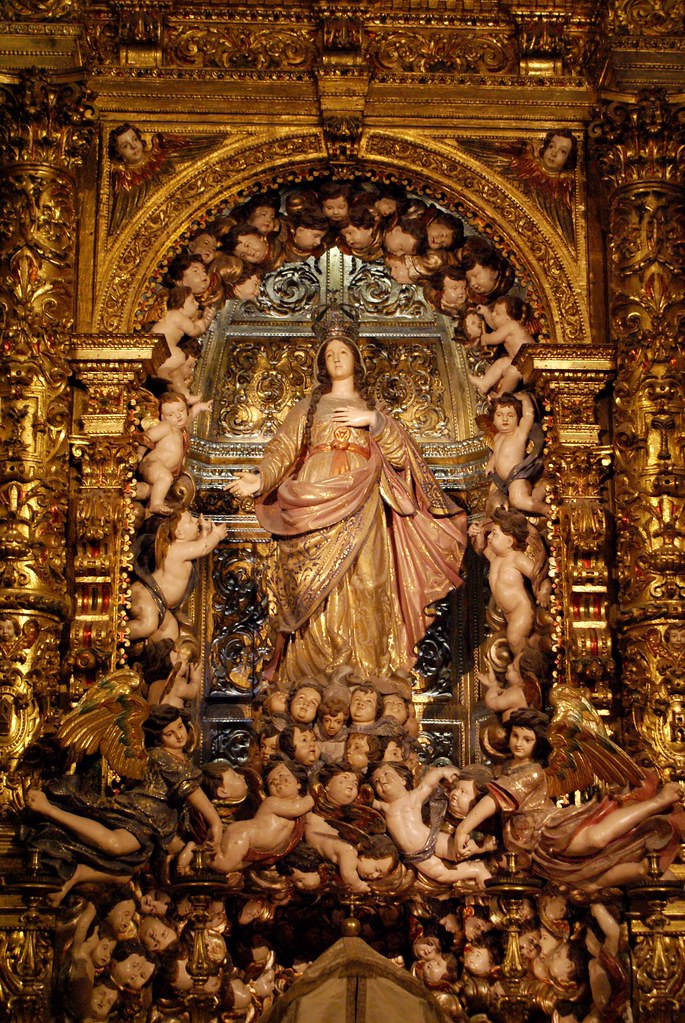

Eglise Saint Roch.

On continue à longer le Bairro Alto pour arriver à l’une des églises baroques les plus surprenantes de Lisboa. Etincellant de richesse.

Miradouro de São Pedro de Alcântara.

Une agréable place avec son kiosque où boire un café en face de l’une des plus belles vues de la ville (et oui encore).

Couvent de Cardaes.

Voici un lieu hors du temps et peu connu. Ce couvent est une merveille et un passage obligé si vous aimez les azulejos.

Principe Real.

Un quartier chic avec de nombreuses boutiques de luxe dans d’anciens palais. Au milieu un agréable jardin avec des kiosques où boire un verre et un marché le samedi matin. Le jardin botanique est tout proche comme le musée d’histoires naturelles.

Jardin d’Estrela

Voici le jardin préféré des Lisboètes dans le quartier d’Estrela face à une basilique baroque et accolé au romantique et secret cimetière des Anglais. En remontant vers Campo de Ourique, vous trouverez un marché couvert où manger ou encore le Père Lachaise local : Le cimetière des Prazeres.

Musée d’Orient ou LX Factory ou Musée d’art ancien.

Prochaine étape à choix multiples : La plus belle collection d’art asiatique du Portugal (et l’une des plus belles d’Europe), une ancienne usine transformée en centre commercial et de divertissement sauce hipster (avec street art, bière artisanale et tatouage, not great not terrible) et l’une des plus belles collections de peinture de Lisbonne.

MAAT

Voici un exemple d’architecture contemporaine, audacieuse, innovante et parfaitement intégré à son environnement. La balade le long des quais est agréable et le MAAT propose des expos et rencontre autour de l’art, de l’architecture et de la technologie.

Monastère des Hiéronymites.

L’une des plus belles construction de Lisbonne entre architecture gothique et renaissance se trouve dans le quartier de Belem. Le quartier accueille de nombreux musées et monuments. A partir de sa marina, vous pourrez naviguer sur le Tage en voilier au coucher du soleil pour une expérience extraordinaire.

Longueur du trajet : 8 km

Carte de tourisme : Lieux du guide

Consultez nos cartes avant de visiter Lisbonne :

- Carte détaillée avec plus de 200 lieux : monuments, musées, hébergements, restaurants, bars, cafés…

- Carte des quartiers essentiels et hors des sentiers battus,

- Carte des transports : Métro, tramway, bus…

Voici un guide de voyage différent et gratuit, nos conseils de préparation et des informations pour visiter Lisbonne au Portugal : Combien de temps pour visiter ? Quelle langue parle-t-on ? Que voir et que faire en un 1 jour ou un week-end, grand et petit ? Quelles sont les meilleures visites insolites et guidées en français pour un séjour réussi ?

Ce qu’il faut voir à Lisbonne, que visiter entre jeunes, avec des amis ou en couple, les sites touristiques, les beaux endroits à ne pas rater, les lieux à voir et les choses incontournables.

Ce n’est ni le site du routard, ni le site de l’office de tourisme, ni un blog ou un guide de voyage comme les autres où toutes les propositions de visites se ressemblent. Nous sommes curieux et notre guide touristique de Lisbonne au Portugal l’est aussi. Quelques soit la saison de votre visite, que vous veniez en hiver en amoureux, au printemps en famille, en été entre potes, à l’automne avec vos enfants nous avons quelques propositions insolites et une présentation originale des lieux incontournables. Pour un tourisme inoubliable et responsable.

Carte d’identité de Lisbonne (Portugal)

Lisbonne est la capitale du Portugal, c’est aussi la capitale la plus occidentale d’Europe continentale. Elle est situé à 177 km au sud de Coimbra (Portugal), à 189 km au nord de Faro (Portugal), à 274 km au sud de Porto (Portugal), à 365 km à l’ouest de Séville (Espagne) et à 502 km à l’ouest de Madrid (Espagne)

Lisbonne compte 506 654 habitants en 2017 et 2 705 000 habitants dans l’agglomération. C’est la 12e agglomération la plus peuplée en Europe après Athènes, Rome ou Berlin.

La superficie de la ville est équivalente à celle de Paris intra-muros : 100.05 km2 (105,40 km2 pour Paris).

Le centre historique est construit sur 7 collines : São Jorge, Estrela, Santa Catarina, São Pedro de Alcantra, Graça, Senhora do Monte et Penha de França. La capitale portugaise est située entre l’océan Atlantique à l’ouest et la mer de Paille dans laquelle se jette le fleuve Tage.

Climat méditerranéen. Meilleures périodes pour la visiter : Juin, juillet, août, septembre.

Comme dans le reste du Portugal, c’est l’Euro. Lisbonne est une des capitales relativement abordable en termes d’hébergement . La vie sur place est assez abordable. Les prix augmentent d’année en année.

Traditionnellement une majorité de Portugais est chrétien catholique.

Sans grande surprise, on parle le portugais. Il est très simple d’échanger en anglais et peut être plus surprenant en français !

En route pour le Portugal ! Que visiter et quoi faire à Lisbonne ?

Visiter Lisbonne, c’est presque comme quitter l’Europe pour une île lointaine. La capitale du Portugal a un côté coloré, vivant, populaire que l’on associerait presque plus au continent sud-américain.

Lisbonne est un port. Une porte du Vieux continent ouverte sur l’Afrique, l’Asie et l’Amérique. C’est une ville impériale, monumentale, lumineuse et sublime. Riche d’un patrimoine historique et culturelle, innovante et magnétique, elle réussit de nombreux grands écarts et attire un nombre croissant de touristes et d’expatriés, un tourisme de masse non sans conséquence…

Ce guide de voyage est l’un des plus complets pour préparer votre voyage au Portugal. Vous trouverez les lieux incontournables à visiter à Lisbonne, les coins insolites, les endroits sympas et atypiques à voir, les meilleures activités à faire : Croisière sur la mer de paille, ateliers de création d’azulejos, visites guidées autour de l’histoire ou du street art, monuments hors des sentiers battus, musées à ne pas rater, où sortir, restaurants au bord de l’eau, plages les plus agréables…

Des infos pratiques et utiles pour un week-end en famille, entre amis ou en amoureux : Sélection d’hébergements, itinéraires de balades pour visiter Lisbonne en 1, 2 ou 3 jours, carte détaillée à télécharger, mais aussi les transports en commun, les prévisions météo et les choses à faire si la pluie s’invite pendant votre séjour.

Et dans le guide touristique …

- Des conseils pour venir et se déplacer à Lisbonne: Venir en train ou en bus, rejoindre le centre ville depuis l’aéroport, utiliser les transports en commun, traverser le Tage, partir à la découverte des environs,

- Des infos pratiques et des bons plans pour votre hébergement avec des suggestions faîtes main pour trouver : Hotel, hostel, camping, bateau-hôtel, hébergement insolite ou hôtel de charme. Et encore une fois Lisbonne n’est pas chère.

- Les monuments les plus impressionnant et les musées incontournables à visiter.

- Quoi faireet que visiter d’autres si vous voulez pas vous enfermer, ou si vous voulez aussi découvrir les environs.

- Les accès, tarifs et horaires d’ouverture de la majorité des lieux intéressants. La possibilité d’acheter vos billets coupe fil.

- Des photos de Lisbonne par thématique, pour entâmer votre voyage avant d’y mettre un pied.

- Où découvrir le plus beaux points de vuesur la ville et le coins le plus romantiques où se balader en amoureux. Et les plus arbres aussi, que vous soyez adepte du tree hugging ou pas.

- Les cafés, les salons de thés aux bonnes pâtisseries(pasteis de nada mais pas que), les bars et les meilleurs lieux où sortirou manger.

- Les friperies, les marchés aux puces, les magasins et boutiques à ne pas rater, fringues, décoration, épicerie fine et chocolat,

- Des vidéos, photos, cartes, interviews, fonds d’écrans de Lisbonne.

Site officiel de l’office de tourisme de Lisbonne : A venir.

![Bairro Alto à Lisbonne : Idées de balade [Centre Ouest]](https://www.vanupied.com/wp-content/uploads/miniature-youtube-lisbonne-bairro-alto-300x169.jpg)

![Statue du Christ Roi à Lisbonne : 110 mètres de béton [Almada]](https://www.vanupied.com/wp-content/uploads/lisbonne-almada-jesus2-300x201.jpg)

![Palais National d’Ajuda : Faste de la monarchie portugaise [Ajuda]](https://www.vanupied.com/wp-content/uploads/lisbonne-palais-ajuda11-300x201.jpg)